Financial services startups are playing a role in improving underprivileged populationsÔÇÖ access to banking

Access to banking is something many people take for granted. But according to the┬áWorld Bank┬áthere are nearly 1.7 billion people around the world with little or no access to any kind of formal financial services. In the US alone, over 6% of households in the US, a total of 14.1 million American adults, are considered ÔÇ£unbanked.ÔÇØ

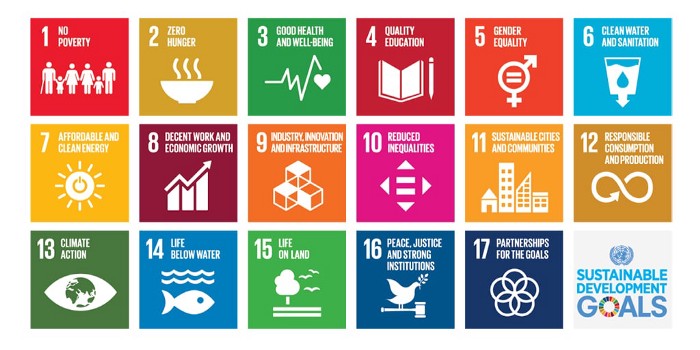

Poor access to financial services, whether in the case of the unbanked or the underbanked (those that have bank accounts but canÔÇÖt access other services such as loans or insurances) is considered as one of the top generators of poverty, together with poor access to other essential services like education and healthcare. It is therefore clear that the UNÔÇÖs blueprint for sustainable development includes the mandate to facilitate access to financial services as a key strategy to combat poverty globally (SDG 1 No Poverty). Achieving this would have a far-reaching effect, as a small loan, savings account, or an insurance policy can sometimes be a game-changing factor for people in need, such as a young adult applying for a loan to finish school or someone recovering from an illness.

Impact Investors are Mobilizing to Eradicate Poverty

In recent years, investors and tech entrepreneurs around the world have begun to realize there is an untapped opportunity in promoting the financial inclusion of underprivileged populations ÔÇö both to meet their financial return targets, as well as create meaningful social impact. According to PitchbookÔÇÖs┬árecent analysis of Impact Investments, financial services is the third most funded Impact area, after energy and health. Impact funds globally channeled over $35.1 billion dollars into financial services with impact targets from 2017 through March 2021.

An Israeli startup making headlines in financial inclusion is microcredit platform L-Pesa, enabling users to build credit history and providing instant cash based on AI data points and APIs.

Read the full story at https://bit.ly/2ZU3ihe