L-Pesa has had a fantastic impact on financial inclusion over the last few years. To understand how far it has moved finance forward, it is worth looking back. Picture the financial landscape just one decade ago within a small village anywhere in the world. If someone wanted access to credit, it was highly possible that there were no formal financial institutions around them. Furthermore, it was not possible to access funds using a mobile phone. The options that remained included savings associations or shylocks. The result was that people opted not to access financial services, which slowed down their overall progress and development.

The poor have been marginalized from financial services for decades. This has meant that they have not been able to gain access to credit and other financial services for various reasons. With the introduction, and uptake of the mobile phone, these barriers are slowly being broken. L-Pesa is a progressive finance service that noticed an opportunity for financial inclusion amongst those who had financial need. Through L-Pesa, those who had been marginalized were finally able to gain access to credit and other financial services.

L-Pesa offers digital microloan services, with minimal criteria for access. This ensures that almost anyone of age can gain access to funds when they need from. This has reduced the total number of people who are unbanked. Over the years, the service offerings have evolved with global trends, such that it is not possible to access the cryptocurrency Kripton, using L-Pesa.

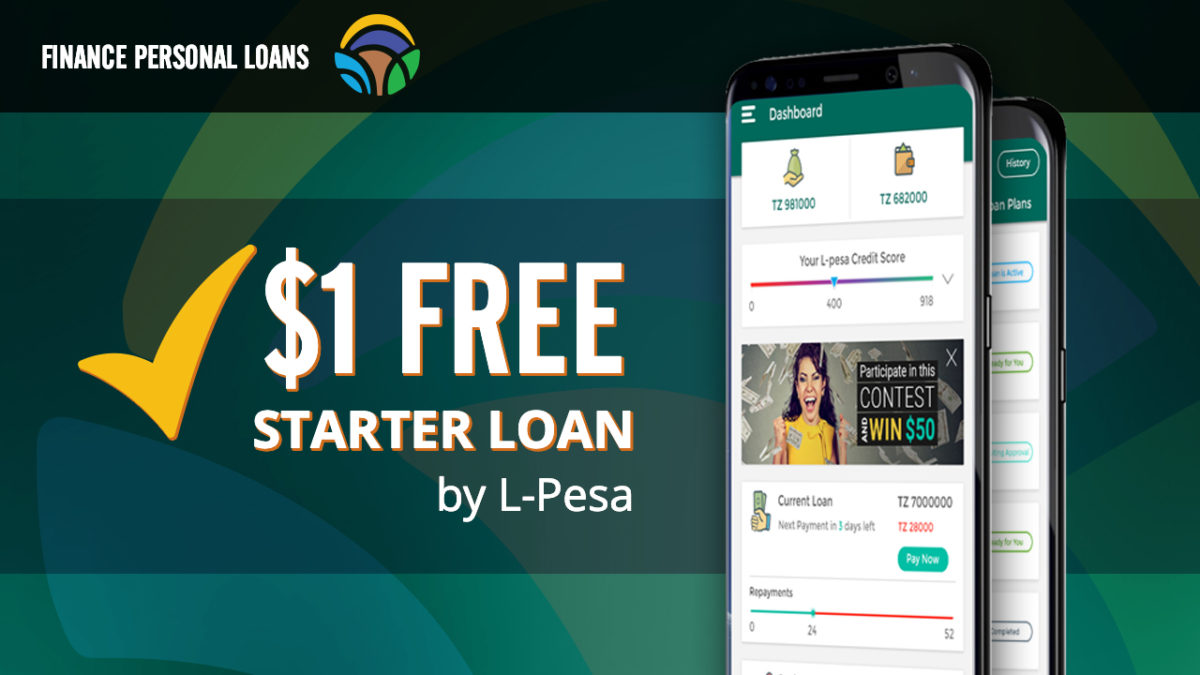

With the funds that people can access through L-Pesa, it is now easier to go into business or invest, as well as to meet daily needs. L-Pesa goes further by also including financial management as part of providing funds to the unbanked. All users begin with small micro loans of $1 and are given stipulated times to pay back. When the borrowers pay back on time, and in full, they can access higher loans and get a credit score. Over time, and with good borrowing and paying back, it is possible to access loans up to $700, using a simple mobile device.

Using L-Pesa has ensured that those seeking financial services are able to have a seamless experience. This service has broken down barriers. Those who may have been intimidated by formal banking institutions, or wanted to keep their finances private, are not able to do so.