Financial services startups are playing a role in improving underprivileged populationsÔÇÖ access to banking

Access to banking is something many people take for granted. But according to the┬áWorld Bank┬áthere are nearly 1.7 billion people around the world with little or no access to any kind of formal financial services. In the US alone, over 6% of households in the US, a total of 14.1 million American adults, are considered ÔÇ£unbanked.ÔÇØ

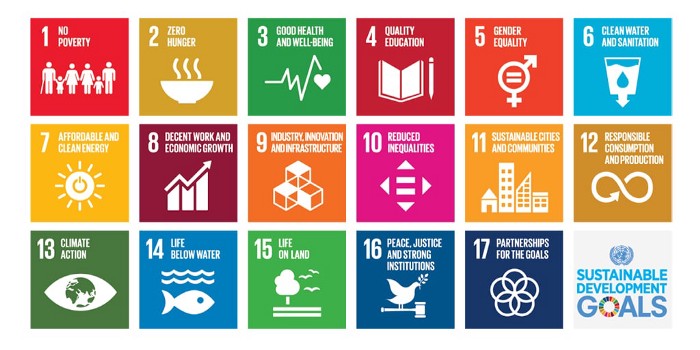

Poor access to financial services, whether in the case of the unbanked or the underbanked (those that have bank accounts but canÔÇÖt access other services such as loans or insurances) is considered as one of the top generators of poverty, together with poor access to other essential services like education and healthcare. It is therefore clear that the UNÔÇÖs blueprint for sustainable development includes the mandate to facilitate access to financial services as a key strategy to combat poverty globally (SDG 1 No Poverty). Achieving this would have a far-reaching effect, as a small loan, savings account, or an insurance policy can sometimes be a game-changing factor for people in need, such as a young adult applying for a loan to finish school or someone recovering from an illness.

Impact Investors are Mobilizing to Eradicate Poverty

In recent years, investors and tech entrepreneurs around the world have begun to realize there is an untapped opportunity in promoting the financial inclusion of underprivileged populations ÔÇö both to meet their financial return targets, as well as create meaningful social impact. According to PitchbookÔÇÖs┬árecent analysis of Impact Investments, financial services is the third most funded Impact area, after energy and health. Impact funds globally channeled over $35.1 billion dollars into financial services with impact targets from 2017 through March 2021.

Israeli FinTech Leads the Charge on Financial Inclusion

Israel is a renowned industry leader in┬áFinTech,┬áTelecommunications, and┬áInformation Security, home to more ÔÇÄthan 530 FinTech startups that leverage data science, ÔÇÄbiometrics, blockchain, and cyber technologies to disrupt the traditional banking, finance, ÔÇÄand insurance sectors. Israel has all the right ingredients to innovate sustainable solutions to complex challenges. When translating the financial inclusion challenge into tech-investable areas, it refers mostly to mobile banking for the underbanked and unbanked, lending solutions, and personal finance management for underprivileged populations. These are all areas where IsraelÔÇÖs ÔÇÄtechnological strength shinesÔÇÄ.

One example is the Israel-based mobile banking solution┬áFIDO Credit┬áthat makes credit accessible to the unbanked in Ghana. Thanks to this platform, which makes instant credit available without requiring the customerÔÇÖs credit history, business owner Mohammed Umoru was able to stop driving almost 100 miles in each direction to receive a loan for the raw materials he needed to develop his business.

Another Israeli startup making headlines in financial inclusion is microcredit platform┬áL-Pesa, enabling users to build credit history and providing instant cash based on AI data points and APIs. One example would be a woman in Uganda who is able to attain a credit line of $70, of which she utilizes roughly a third each morning ÔÇö $20ÔÇô25 ÔÇö in order to buy mangos to sell throughout the day, repaying the loan in the evening and retaining her daily profit. With over 700,000 customers in Tanzania, Kenya, and Uganda, L-PesaÔÇÖs goal is to develop long-term relationships that are mutually beneficial to both the customer and the loan provider; L-Pesa incentivizes timely repayment and other financially responsible behavior by increasing available credit limits over time.

Focused on enabling users in India, Kenya, Vietnam, and Mexico to build credit history, Israeli startup┬áConfirmUÔÇÖs alternative credit scoring method collects data in a different way ÔÇö building mutual trust through a three minute game with fun challenges involving varied nuances for different types of loans, such as agricultural versus urban lending. Then there is┬áInnovative Assessments, which developed a method for evaluating credit risk based on psychometric scoring, testing for certain personal character and behavioral traits that can help determine risk factors and dependability; approximately 1.5 million users in twenty countries have taken this unique credit test. Working in conjunction with local banks and online lenders, this Israeli FinTech pioneer promotes economic success for small business owners and provides access to higher education through more accessible student loans.

In this context, it is worth noting college planning platform Frank, recently acquired by JPMorgan. The online portal offers tools that help students apply for and negotiate financial aid, enroll in online courses, and find scholarships. Since its launch in 2021, it has served more than 5 million students at 6,000 institutions.

Lastly, we have personal finance management company┬áFamilyBiz, which created a financial technology system that provides private users with advanced social financial tools. Their system automatically gathers all of the userÔÇÖs financial data, including credit cards, bank accounts, investments, mortgages, real estate, and insurance and pension data. The FamilyBiz software allows users to run a current budget with a personalized comparative report system. Using special bots and algorithms, the system builds a business plan to help users realize their financial goals.

These are just some of the many Israeli FinTech companies listed in our Start-Up Nation Finder Business Discovery Platform. Interested in knowing more about Israeli startups working toward the UN Sustainable Development Goals? Contact us here for more information. In the meantime, keep your eyes on this space for further installments in our new blog series focused on Impact-Tech in Israel.

Source: START-UP NATION https://blog.startupnationcentral.org/general/impact-tech/israeli-fintech-innovators-helping-combat-global-poverty/