For those who want to experience the benefits of crypto-fiat but don’t know where to start or what it means; L-Pesa has created an all-in-one solution with Kripton coin. You can now use this Kripton coin through its updated DeFI Ecosystem Dapp that provides 5 key innovations for Africa: Swap (exchanging other currencies) Bridge (used…

Category: Financial inclusion

Posted by: admin  September 5, 2021

September 5, 2021

Kripton Bridge -Stable Coins Exchange Value Across Blockchains

As the size and number of blockchain networks grow, the need for value exchange across blockchains is becoming evident. Unfortunately, most chains remain primarily disconnected from one another ÔÇô like islands with separate economies and communities, unable to exchange value or information with the world outside. That siloed nature goes against the idea of decentralization.…

Posted by: admin  September 5, 2021

September 5, 2021

Kripton: A Revolutionary Token for Microfinance

Cryptocurrency is the future of microfinance. Well-packaged services will give power to low-income people who are often neglected by their financial systems. Traditional financial systems think of low-income earners as uneconomical to serve or hard to reach. The World Bank estimates that there are close to two billion financially excluded adults in the world. These…

Posted by: admin  May 28, 2020

May 28, 2020

The Age of Your Business Could Help You Get a Good Loan

Did you know that the age of your business┬áhas an enormous impact on what kind of loans youÔÇÖll be eligible for? What L-Pesa Are Looking For When we are considering┬áat a borrower, we want to know how likely we are to get┬áour money back. While credit score and monthly revenues are a good way for…

Posted by: admin  May 18, 2020

May 18, 2020

L-Pesa now in MOMO – Leading mobile wallet in Uganda

L-Pesa Micro Finance, East AfricaÔÇÖs leading mobile financial inclusion services provider, has formed a strategic partnership with MTN┬áUganda ÔÇô a part of the MTN Group, the worldÔÇÖs largest mobile payment platform. L-Pesa Micro Finance is the leading mobile financial inclusion services provider operating in East Africa with over 500,000 customers in Kenya, Tanzania, and Uganda.…

Posted by: admin  March 26, 2020

March 26, 2020

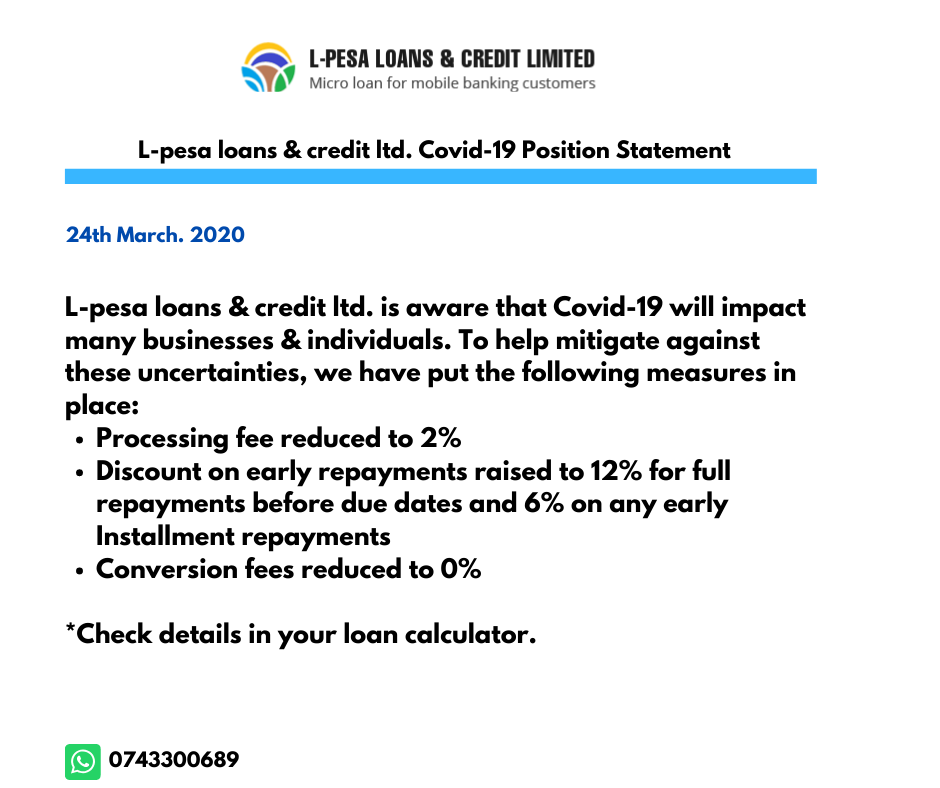

COVID 19 outbreak period

L-Pesa is concerned about you and we are making the following changes to our service during this COVID 19 outbreak period. Keep your friend and family safe.

Posted by: admin  March 7, 2020

March 7, 2020

L-Pesa and MTN ÔÇô Financial Inclusion through MOMO

The future is mobile. L-Pesa is a mobile money service that has years of experience offering modern money solutions to people around the globe. Through this service, lives have been elevated and financial inclusion is building societies. With L-Pesa, it is possible to get access to microloans with just a swipe. All that is needed…

Posted by: admin  February 26, 2020

February 26, 2020

The L-Pesa Line of Credit

Finance has evolved in this new decade. Where just ten years ago, gaining access to financial services was limited to a select few, today everyone can benefit from financial services. Modern finance services are just a swipe away with L-Pesa services. Using mobile technology for access, L-Pesa ensures financial inclusion, through providing a line of…

Posted by: admin  February 12, 2020

February 12, 2020

L-Pesa Makes Mobile Banking Easy for Everyone

L-Pesa is a progressive finance service that is transforming financial inclusion around the world. Through L-Pesa it is possible for anyone with a mobile device to access microfinance services, through loans. If you are above 18 and have a registered mobile phone line, you are legible to access L-Pesa services. To access an L-Pesa loan,…

Posted by: admin  January 23, 2020

January 23, 2020

How flexible microfinance can lift people out of poverty

In 1976, when Muhammad Yunus, an economics teacher at the time, lent $27 to a group of 42 women in the village of Jobra, Bangladesh, he could not have imagined the eventual impact this small gesture of goodwill would have. Original source -  https://medium.com/@ashley.potter/how-flexible-microfinance-can-lift-people-out-of-poverty-b6af5413d3b4